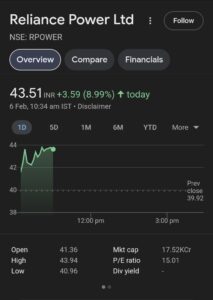

Reliance Power Ltd NSE: RPOWER

Reliance Power’s Share Price Soars Amidst Financial Turnaround and Strategic Initiatives

Pune, February 6, 2025, Maharashtra — The share price of Reliance Power Limited, a well-known company in the Anil Dhirubhai Ambani Group (ADAG), has recently increased significantly, indicating both a strong financial recovery and tactical developments in the renewable energy industry.

Financial Results and Changes in Share Prices

The National Stock Exchange (NSE) saw Reliance Power’s stock close at ₹39.95 on February 5, 2025, up 0.56% from the previous day’s close of ₹39.46. The company’s latest financial disclosures, which have increased investor trust, are consistent with this increasing trend. In the quarter that concluded in September 2024, Reliance Power reported generating ₹1,963 crore in total revenue, which added ₹2,779 crore to its net worth of ₹14,393 crore. By lowering its debt-to-equity ratio from 1.61:1 in FY 2024 to 1.02:1 in the July–September 2024 quarter, the company has reached a noteworthy milestone, demonstrating its dedication to sound financial management.

Strategic Renewable Energy Initiatives

In a Solar Energy Corporation of India (SECI) auction, Reliance Power and its subsidiary Reliance NU Suntech won a 930 MW solar energy project with a 465 MW/1,860 MWh battery storage system, indicating a strategic shift towards sustainable energy. A four-hour daily peak power supply is part of the 25-year project, which was awarded at a tariff of ₹3.53 per kWh. It will be incorporated into the interstate transmission system.

Reliance Power has teamed up with Bhutan’s government investment agency to create 770 MW of hydropower and 500 MW of solar power projects, further increasing its presence in the renewable energy sector. This partnership demonstrates the company’s dedication to local sustainable energy projects and its plan to diversify its energy sources.

Corporate Governance and Legal Developments

The Delhi High Court granted Reliance Power temporary reprieve in December 2024 by reversing a three-year ban imposed by SECI, which had charged the business with presenting a false bank guarantee. A vital component of Reliance Power’s business operations, the court’s order permitted the company to keep taking part in clean energy project bidding.

In spite of these obstacles, Reliance Power has remained committed to enhancing legal compliance and corporate governance, guaranteeing responsibility and openness in its business practices.

Market Prospects and Investor Attitude

The increase in Reliance Power’s share price is proof that the company’s recent strategic and financial advancements have improved investor sentiment. The stock has increased by 21.67% in the last six months and 45.69% throughout the course of the last year. The 52-week range shows considerable volatility and development potential, ranging from a low of ₹19.40 to a high of ₹53.64.

Analysts credit the company’s smart investments in renewable energy, excellent debt reduction initiatives, and good legal decisions for this upward trend. A debt-free position following the payment of ₹3,872 crore in liabilities has improved the company’s financial strength and investor trust.

In conclusion

Reliance Power’s dedication to sustainable growth and the creation of shareholder value is demonstrated by its recent financial performance and strategic initiatives. The company’s concentration on renewable energy projects and financial discipline position it favorably for future ventures as it continues to navigate the changing energy landscape. To make wise choices, investors are encouraged to keep an eye on the company’s continuing initiatives and market trends. The market’s confidence in Reliance Power’s strategic direction and operational resilience is reflected in the upward momentum in its share price.

Recent Advancements in the Renewable Energy Projects of Reliance Power

Last month, the Solar Energy Corporation of India (SECI) had barred Reliance Power from bidding for its tenders for three years and was weighing criminal proceedings against the company after a bank guarantee turned out to be a fake endorsement.

YouTube video link for more information

Pingback: zomato new name2025